“There’s always a fear of the unknown, but we are extremely happy with SIS and Partner XE. They’ve kept their word and helped us run better as an agency.”

– Jim Waun, Vice President, Sweet & Associates

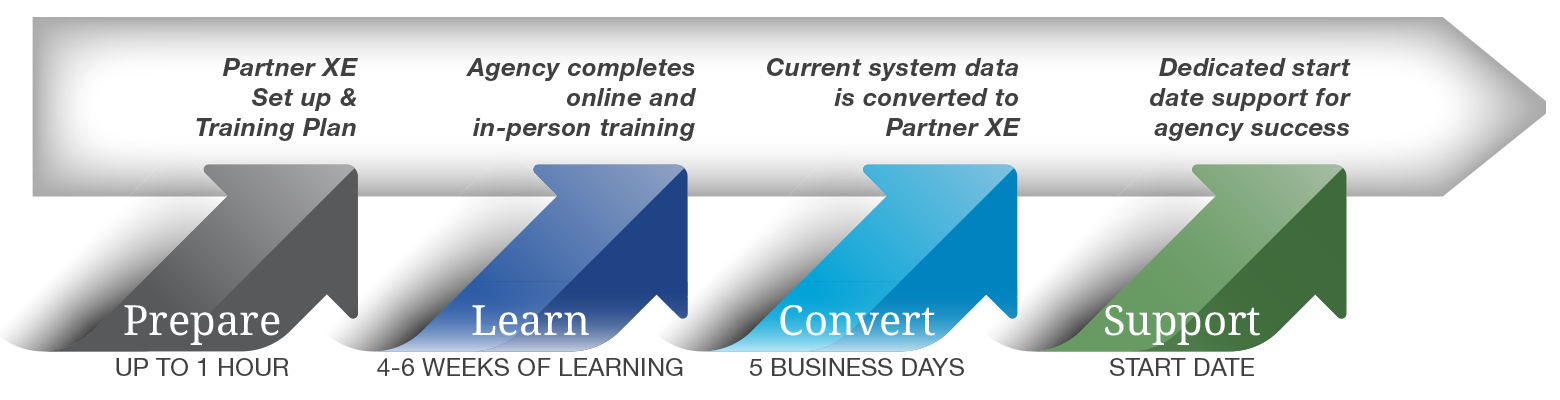

With hundreds of conversions from more than 20 different agency management systems under our belt, SIS has designed the Partner Platform’s StartRight implementation process to make your transition simple, flexible and low stress. Our commitment to your success begins the minute you come on board.

Prepare

The Partner Platform team will work with your agency to prepare you for the transition from your old agency management system. The introductory kick off meeting is designed to help you gain comfort and trust with the team that will be supporting you throughout the change. You’ll be made aware of key milestones, what to expect and when and how we’ll support your agency.

Learn

Our implementation and training team will set up your personalized online learning program for your agency. You will get an introduction to the agency management system, as well as all of our support resources through this comprehensive process. In addition, if you have chosen to have an onsite training, we will work with you to create a plan uniquely suited to your agency.

Convert

The team of data experts will convert your data into the Partner Platform. Your data will be provided in the form of a backup from your current provider. Your agency and staff will also get support to ensure your carrier downloads are available and arriving in the right places.

Support

The Partner Platform team will provide you with support on your “Start Date” (go live day) to enable your team to get questions answered and gain comfort working in the Partner Platform. In addition, the client services team will also be a resource to so that you and your staff can shift back from learning to servicing your clients.