Agency Management System Best Practices, Technology Trends

As Director of Product Management, I spend a lot of time talking with clients about their agency management system needs. One component that comes up over and over again is mobile access.

Agency members see a mobile agency management system as critical to operations. Whether they use it once a year, every day, or only in the event of an emergency, clients tell me the “always accessible” nature of mobile is crucial for many reasons. Some top motives are:

On the road access

Agency owners and Producers spend a lot of time away from the office and use their management system’s mobile app on a daily basis. Many recall the days of contacting their agency for a phone number or other small piece of information. Now, they can access this essential information within seconds.

Our Partner XE users say this quick mobile access better prepares them for meetings with prospects and clients, boosting their selling ability. With the Partner XE Mobile App, users can view accounts, add information, create reminders, and even look up documents on the spot: all of which are now expectations from a prospect’s point of view.

Work from home opportunities

Mobile access is important for those who spend most of their time in the office as well. Think of the times you’ve had to call in sick (for yourself or your kids) when you know you have a lot of follow-up calls scheduled. Or when you had to leave the office early and received a call from a co-worker asking questions about an account. Insurance moves at a fast pace, and missing those moments to close a gap or connect with a customer make a difference. Knowing you can access information whether you’re in the office or not gives peace of mind our Partner XE clients value.

Emergency situations

Disaster is, unfortunately, unpredictable and emergency situations happen. In the event of disaster, mobile agency management system access can be a lifesaver. One of our long-time clients had such a situation occur when they had a fire at their agency. Everything was gone – total loss.

Thankfully, they were able to move into a temporary location right across the street. However, it took time to get new workstations together and set up. During that transition period, staff was able to access important accounts and do critical follow-ups through their mobile app. In many ways, mobile access brought stability to an unstable situation and helped the agency tremendously.

With so many benefits, mobile access must be pricey – right? For Partner XE users, it’s already paid for! The mobile app is part of our monthly support and maintenance fee. After a small one-time fee installing from the app store, there is no extra cost to Partner XE clients.

SIS is committed to enhancing Partner XE, and especially our mobile app functionality. To find out more about what Partner XE can offer you and your agency, check out our features and contact us at [email protected].

Agency Accounting, Choosing an Agency Management System

Integrated insurance agency accounting is the bacon of your business.

Yes, this is a bold statement. But, hear us out: both are great on their own – and serve as a staple in your agency (or kitchen, respectively). Starting to see the similarities?

Look at it this way:

- Bacon can make things we don’t enjoy suddenly enjoyable. Dreading that salad? Add bacon! Have a lack luster soup? Bacon works there, too!

- Integrated accounting – though not edible (or as delicious) possesses this same versatility. Sick of time drains like commission matching and invoicing? Add integrated accounting! Frustrated with compiling complex reports? Integrated accounting can simplify your life!

Here are just a few examples of how integrated accounting can transform cringe-worthy aspects of your operations:

- Policy Commissions: Integrated accounting saves hours of searching and eliminates incorrect assignments. It syncs easily with Direct Bill Commission Downloads, connecting commissions to clients and policies instantly.

- Invoicing: When accounting links with your management system, invoicing is almost automatic. The systems knows what premium is due when, filling in information for you. And installment invoicing is a breeze since policy information is readily available in the same system.

- Agency commissions: With integrated accounting, commission templates can be created to calculate money due automatically. Commissions can be based off of multiple criteria, including transaction type, new business versus renewal, producer and/or CSR and line of business.

- Reporting: Integrated accounting offers better reporting solutions and automated complete financial reporting. If your agency’s data is in one database, you will no longer have to run twice as many reports or merge two sets of data together.

Bottom line: integrated accounting makes daily agency processes more appetizing.

Integrated management system accounting saves time, decreases frustration, and offers better workflow. Entering data once cuts down on keystrokes and makes it easier to find and integrate information. The benefits increase more with multiple locations and/or books of business. A general accounting program simply isn’t fit to handle a complex insurance agency account set-up.

We’re making integrated accounting delicious at SIS.

At SIS, we recognize the benefits of integrated agency management accounting and take it one step further. The Partner XE accounting system is designed specifically for independent agencies by independent agencies.

Our accounting system goes beyond integrations with Quickbooks: it’s built in as part of our software program. This agency-focused system can handle:

- General ledger, chart of accounts, and client ledger,

- Agency and producer commission reconciliation,

- Vendor bills and direct bill commission downloads,

- Payroll and withholding templates, and

- So much more!

To find out more about our comprehensive Partner XE system and its many capabilities, contact us at 800.747.7005, Option 6.

Agency Management System Best Practices, Agency Operations, Technology Trends

Agencies are constantly looking for ways to build and improve efficiency. However, many fall short. Why? The answer lies in which tools agencies are using – or not using – to streamline processes.

(more…)

Choosing an Agency Management System

Your agency is made up of people: each with unique personalities, preferences, and positions. So, why force each to use your insurance agency management system in the same way?

Different people and roles need different things from your agency management system. And your agency has different needs than other agencies. You’re an independent agency – you adapt to serve your local community. Shouldn’t your management system adapt to serve you?

Enter personalized workflows

Personalized workflows are just what they seem: system processes and views adjusted for your agency and your staff. Examples include:

- Tailored naming conventions

- Multiple pathways for a single process

- Customized home screens

Each agency and person uses their management system differently. One natural differentiation is by roles – for example, producers have different priorities and daily needs than CSRs. Their agency’s management system should meet their varied need.

Adapt your system for each role

Producers

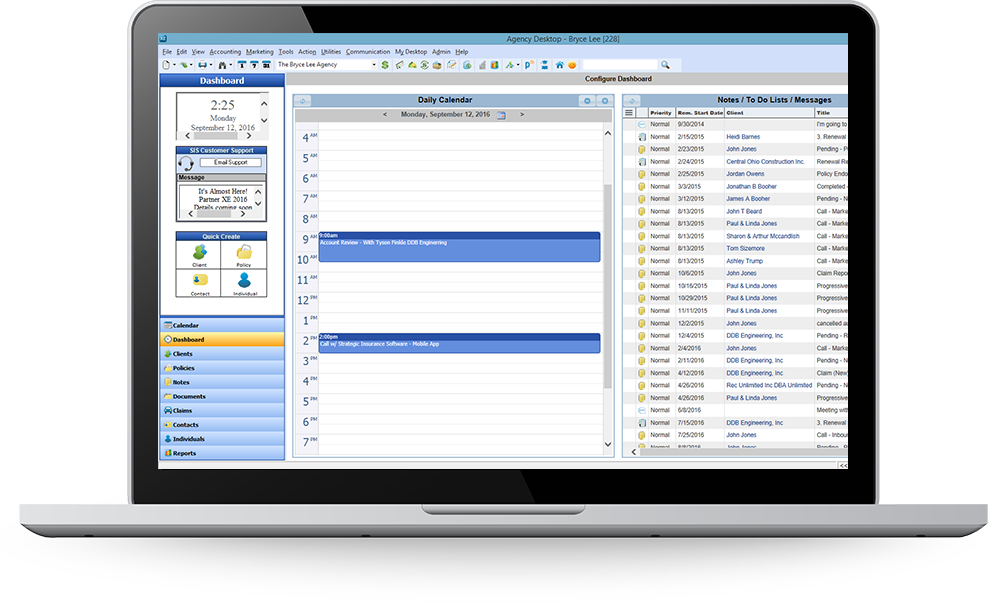

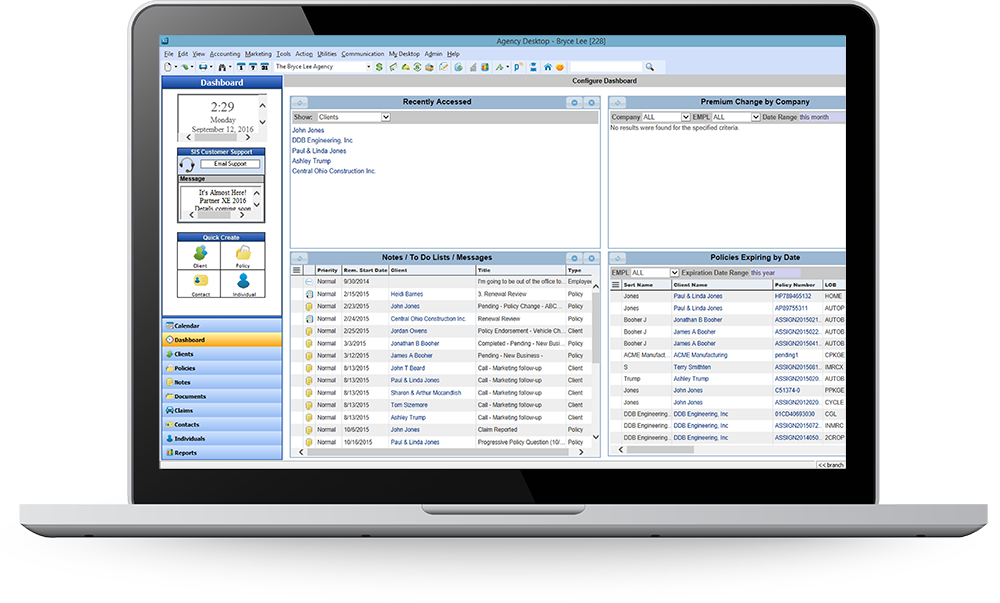

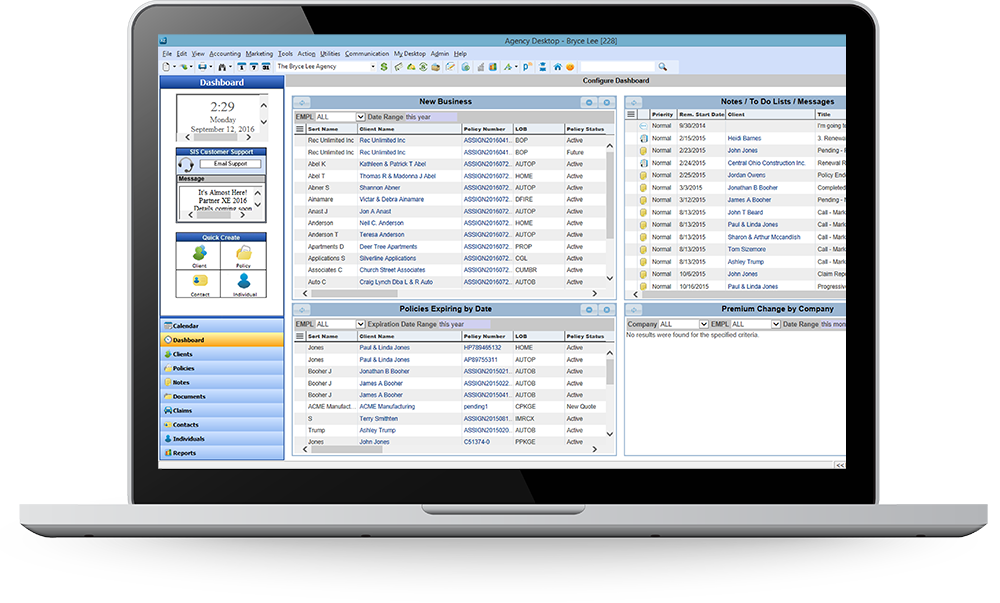

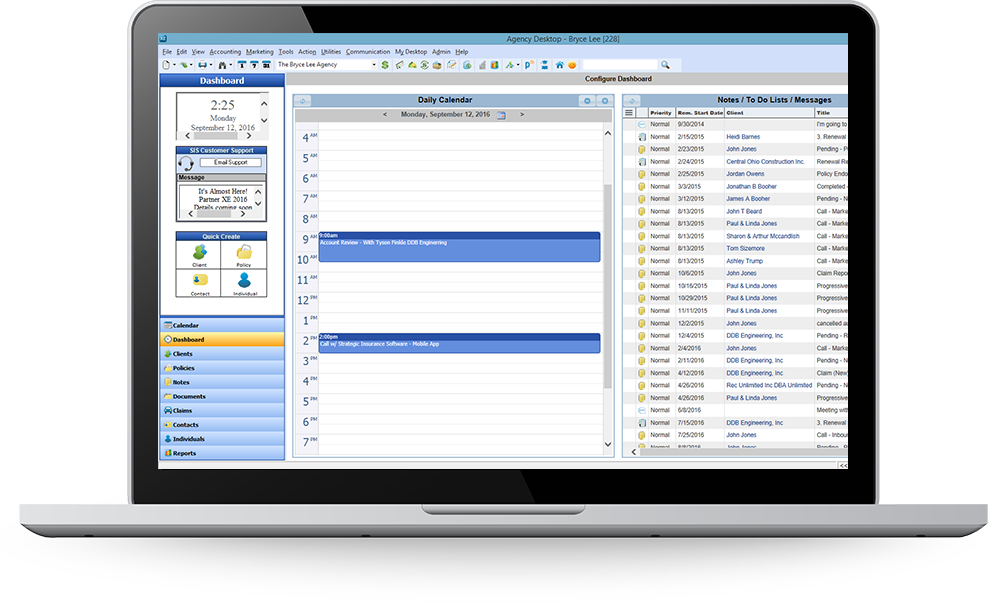

With a heavy sales focus, producers spend most of their time looking at prospect profiles, tracking “x” dates, and checking their commission reports. An ideal producer home screen shows a running to-do list and calendar – likely pulled up on a mobile app. Producers also benefit from simple, straightforward workflows for viewing and editing profiles and reports.

CSR

Ideal customer service is quick and courteous. The last thing a CSR wants is to fumble around for information, growing more frustrated each minute. Streamlined paths and quick links to common procedures relieve stress, allowing reps to deliver the best service. Though each CSR home screen will look different, most will contain quick links to regular tasks, relevant customer profiles, and essential reports.

Owner/Principal

An owner or principal needs a 360-degree view of their agency – and they need it fast. A principal’s dashboard may contain accounting reports, new business reports, and producer stats among other items. Like a producer, principal-owners look for the quickest way to get the information they need, striving for intuitive management system data paths.

Find it all in one system

Meeting individual needs is what we do at Strategic Insurance Software. The Partner XE agency management system was created to serve agencies with built-in personalized workflows, easy reporting, and integrated accounting among other features. We believe in challenging the status quo: asking our customers what they need and delivering.

Find out more about the Partner XE system, including our customer-driven capabilities, at sispartnerplatform.com. Or, contact us at 800.747.7005, Option 6 or [email protected].