Agency Operations

While most of what we post to our blog here at SIS is directly related to our Partner XE insurance agency management system, there are so many other elements that go into the making of a successful independent insurance agent ( or anyone for that matter) that when we find something like this TED talk — an idea truly worth spreading — we want to share it.

Q: What do the words Passion, Work, Good, Focus and Push all have in common?

A: They are all part of Richard St. John’s Eight Secrets Of Success. While not new, this three minute TED talk video we found is too good not to share!

Agency Management System Best Practices

Partner XE Insurance Software FAQ’s

Q: “I did not receive my downloads today. What should I do?”

A: If your workstation is shut down, restarted, in sleep mode or logged off during the automatic download process, your downloads will not run automatically. You will first need to verify that the Download Transfer Utility is running on your download machine and then run a manual download. (more…)

Agency Operations, Change Management, Choosing an Agency Management System

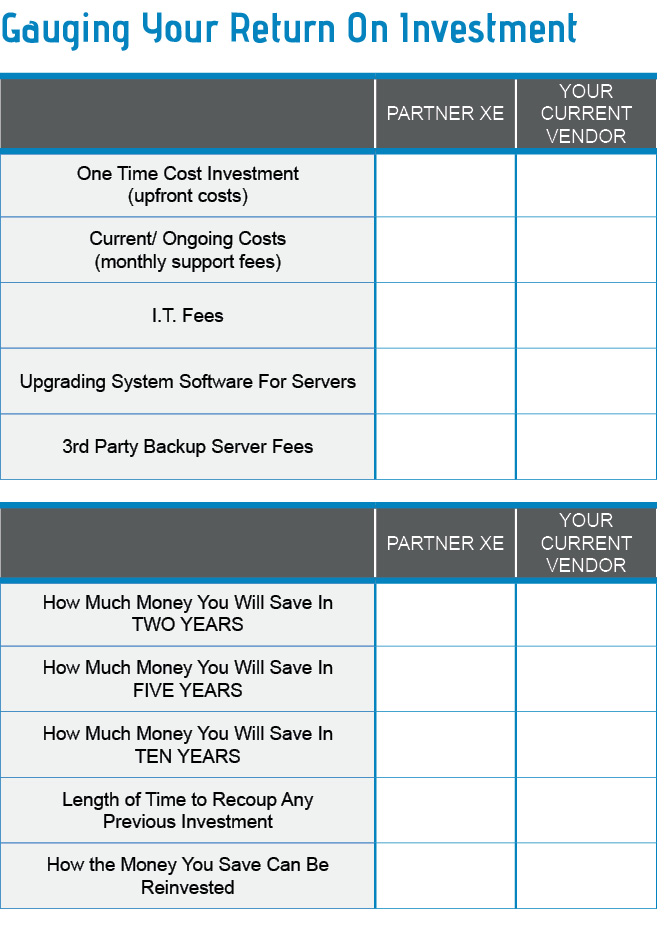

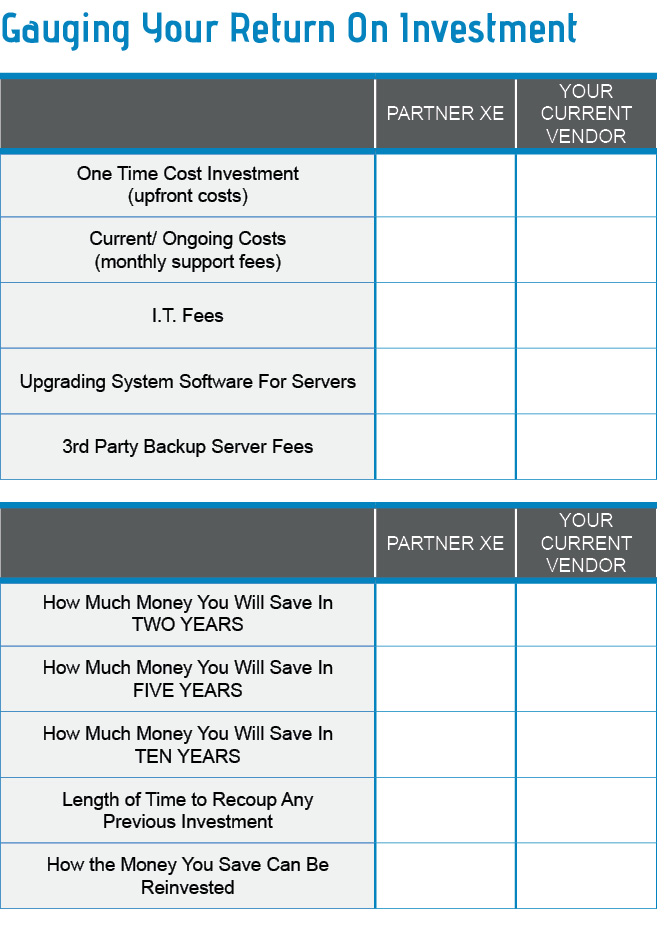

Gauging your ROI when switching agency management systems.

It is easy to look at all the things that frustrate you about your current agency management system and want to run to greener pastures. Think about it. How often have you

- Wished your agency management system was more intuitive to use,

- Thought about how great it would be to reduce or eliminate IT and server costs,

- Wished your agency management system gave you better visibility into your business so it could be managed more effectively,

- Wished you could take advantage of all those Real Time and download capabilities that are out there,

- Gotten frustrated with a vendor who keeps making you switch platforms, but then got hung up on the misconception that it would take too long to recoup your investment if you decided to switch systems?

When you switch to the cloud based Partner XE agency management system from SIS, the issues above will be a thing of the past.

The question is, however, is whether it’s worth the time and money it takes to invest in a new system.

The question is, however, is whether it’s worth the time and money it takes to invest in a new system.

To help you decide, we’ve put together a return on investment worksheet that we can review with you at your convenience. Just contact us and let us know you’d like to do an ROI analysis and we’ll walk you through it.

Ultimately, things to consider include your one-time upfront investment, your monthly support fees, I.T. fees, the cost of upgrading your system software for servers, third party backup server fees and more.

If you are currently running an in house server based system, think about how much you have invested in

- Servers

- Installation

- Networking

- Routine maintenance and security patches

- Implementation of large scale patches and upgrades

- Unexpected troubleshooting/ maintenance

- Employee down-time when they have to take time off to perform the above tasks

And think about the future investments you will need to make should your server become technologically obsolete.

Since Partner XE is cloud based you are instead dealing with constant, monthly, budgetable costs (based on the number of users you have on the system) which are easily scaled as you add or drop users.

This is a huge plus when figuring ROI.

Click here or call 800-747-9273 to schedule a free agency management system assessment, consultation and ROI analysis. Once you run through the numbers, you just may decide to join the growing ranks of agencies nationwide who are switching to Partner XE.

Agency Management System Best Practices, Agency Operations, Cyber Security, Technology Trends

Combat Cybercrime at your Independent Insurance Agency

Simple security steps every agency should take

Even though SIS’ secure hosting environment for our Partner XE agency management system provides clients with access to secure servers housed off-site at an impregnable data center, around the clock physical security, internet and server firewall data protection, malware protection & anti-virus and weekly security patch updates to Windows, we feel like you can never have enough information about protecting your data to combat cybercrime.

Awhile back we blogged about software as a service and how your Partner XE agency management system’s hosted model provides you with redundant backups of your data and protects you against computer failures, natural disasters and more. We also talked about how the fact that off-site data storage increases your protection against from hackers.

Today, we want to share some good information which was put out by the Independent Insurance Agents & Brokers of America, Inc. on cybercrime. While SIS and Partner XE offer the high level of protection necessary for your important system data, there are some key things you can do at your office as well to cover your computers and files.

Danielle Johnson’s article “Combat Cybercrime and Protect Your Agency with Simple Security Steps,” discusses the extent of the problem and outlines steps you need to take to protect your customer’s valuable information.

She suggests that “to assess the risks associated with a cyber intrusion of your agency’s online systems and critical client data, ask yourself a number of questions,” including:

- Does the network firewall include anti-virus, anti-spyware and anti-spam services along with content filtering and intrusion prevention, detection and real-time reporting?

- At the individual PC level, does each computer have centrally updated and monitored anti-virus, anti-spyware and anti-spam software loaded?

- Are your computers set up to automatically update your operating system and applications for the latest available security and critical updates?

- Does your agency back-up critical files in case of an issue that disables your systems?

For more information and questions to consider, read the full article…

Agency Operations, Marketing, Technology Trends

As we wrote in our February post “Marketing with Partner XE” customer retention must be a high priority for any independent insurance agent who wants a profitable book of business. We wrote that communicating regularly with customers is one way of keeping them loyal and talked about how to use features in Partner XE to facilitate that process. We also alluded briefly to Social Media as one piece of an overall integrated marketing strategy.

Today we’d like to share an example of how insurers are using Social Media platforms such as Twitter and Facebook not only to keep their names in front of customers , but also to provide them with better service.

Marguerite Tortorello wrote in a recent edition of National Underwriter P & C, that “The latest tornadoes offer a case study of how communications between insurers and the public have dramatically changed—and how this transformation is helping insurers provide better customer service to those in need.”

She went on to give specific instances of insurers who used Social media to keep customers informed — from Alfa Insurance who posted a YouTube video on storm claims, to Amica Insurance who tweeted tips on tornado preparedness. Read the full post… We hope you’ll get some good ideas!

The question is, however, is whether it’s worth the time and money it takes to invest in a new system.

The question is, however, is whether it’s worth the time and money it takes to invest in a new system.